Page 7 - RENJ May 2021 Issue 53

P. 7

EDITOR’S NOTE

REALESTATENJTM 5

RISING ABOVE

All things considered, New Jersey developers were fortunate to be able to continue construction

during the height of

last year’s COVID-19 crisis, even with the uncertainty that suddenly loomed over the market.

Many had placed big bets on

the ongoing demand for luxury apartments, fueling a pipeline of projects that are coming online a year after the start of the pandemic.

Kushner Real Estate Group

was among those with much at stake. Look no further than the developer’s landmark Journal Squared project in Jersey City, where it recently unveiled a second soaring residential tower that delivered another 704 units to the neighborhood.

“Any developer who tells you they’re not nervous is lying to you,” KRE Group President Jonathan Kushner said during a recent interview, as he discussed the impact of the pandemic. “We were nervous, but we had no choice — we had to finish the building.

“Thankfully, we actually finished the building on time and we finished the building on budget.”

KRE Group is also thankful for the response from would-be renters. As you’ll read in this month’s cover story, Journal Squared has generated “enormous demand” since the launch of leasing at the second phase, having filled more than 200 of its 704 apartments in just six weeks from late March

to early May. The demand is not only encouraging for Kushner’s team, which is planning a third tower at the site, but signals continued momentum for a historic neighborhood that once served

as Jersey City’s commercial and cultural hub. A long-awaited revival of Journal Square is now taking shape, with thousands of additional units in the pipeline and new place- making initiatives underway with

city officials at the helm.

Our May issue also features an interview with Mark Meisner,

CEO of The Birch Group, on

his company’s aggressive push

into New Jersey’s suburban

office market. The privately held investment firm has acquired

more than $750 million worth of office property in the state since 2018. That includes its recent $255 million purchase of a four-building, 843,300-square-foot portfolio in

Short Hills from Mack-Cali Realty Corp., in a sign that Meisner is seemingly undeterred by the pandemic and its impact on how tenants will use their space.

Elsewhere in this edition, we detail a recent transaction by our own publisher, Paul Profeta, who has been investing in commercial real estate for more than 45 years. This one took place in Columbus, Ohio, where Montwards LLC, of which Profeta serves as the managing member, agreed to sell the site of

a newly built, 300,000-square-foot Amazon fulfillment center. The deal comes after its redevelopment of a property that it first acquired

nearly two decades ago, and it now plans to use the proceeds to buy an industrial site much closer to home — in central New Jersey — with plans to bring much-needed space to the New Jersey Turnpike corridor.

You can find those stories and more in the latest issue of Real Estate NJ, which brings us ever closer to the summer and the prospect of a more conventional second half of the year. Here’s hoping! Thanks for reading and enjoy the issue!

Joshua Burd

Editor

[email protected]

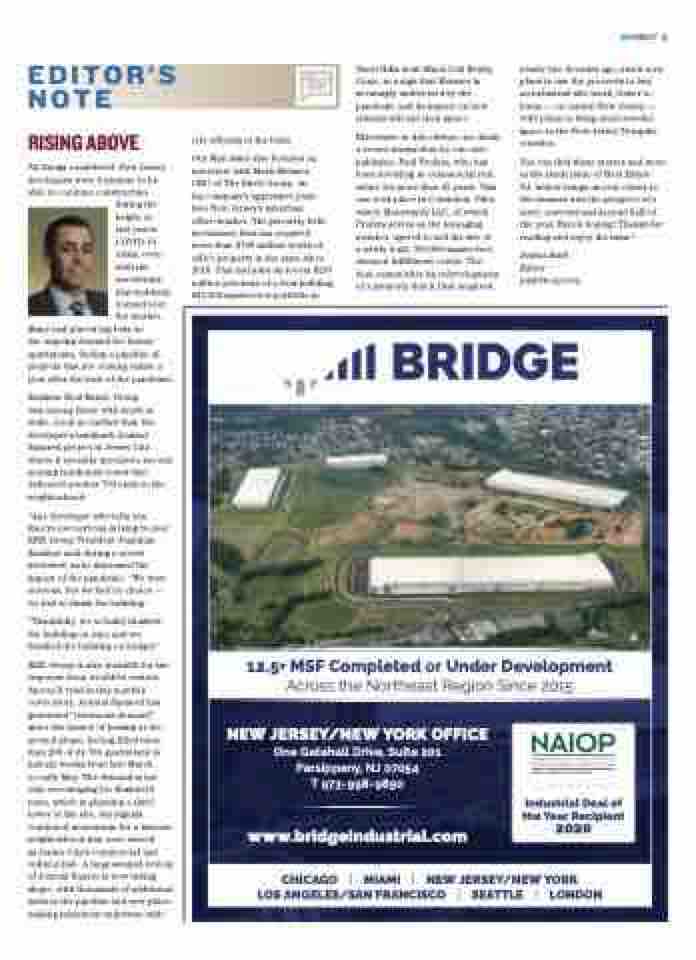

12.5+ MSF Completed or Under Development Across the Northeast Region Since 2015

One Gatehall Drive, Suite 201 Parsippany, NJ 07054

T 973-998-9890

2020

| | | |