Page 27 - RE-NJ

P. 27

pains. “Big city” problems are coming to these markets known for their affordability and quality of life after years of continuous economic and population growth. These destination markets typically offer lower tax rates and lighter regulatory burdens than many gateway markets, heightening their appeal to many businesses. Conversely, some of these attractive characteristics may limit their capacity to accommodate continued massive population inflows. These markets will remain popular for both business and residential in-migration but could

see the pace of both occur at more moderate levels.

SMARTER, FAIRER CITIES THROUGH INFRASTRUCTURE SPENDING

Infrastructure spending is back among the top trends. New federal infrastructure spending provides the opportunity to replace and expand critical urban infrastructure to rebuild cities and spur new development — and address historical inequities. After years of uncoordinated local efforts, the new national programs may provide the leadership needed to transform the built environment.

CLIMATE CHANGE’S GROWING IMPACT ON REAL ESTATE

The CRE sector has an important role to play in mitigating climate change. But with climate risks growing, the real estate industry must proactively address the impacts of climate change on assets. Climate change may alter the dynamics

of where people want to live and invest. In addition to the discomfort and health risks of living in ever- hotter climates, energy costs rise with temperatures, as do the risks

of power outages as more strain is placed on power grids. Extended drought conditions may limit new development because authorities may limit new hookups. Many investors rely on insurance rather than capital improvements to protect their investments, but changing investor sentiment toward climate risks may force more affirmative changes.

ACTION THROUGH REGULATION

Pressures for greater ESG disclosure by real estate owners and investors are intensifying

due to efforts both from industry groups like NCREIF and PREA and from government regulation by the SEC. As shelter costs increasingly strain household budgets, state and

local governments are resorting to regulation to address affordability, including various types of rent control and vacancy taxes. While building owners and developers benefit from various government incentives, the industry faces

an increasingly challenging set

of environmental and economic regulations. Will certain regulations end up being counterproductive? Preceding trends highlighted several areas where private markets have been slow to fix mounting problems that the property sector has played a central role in creating, notably climate change and housing affordability. Industry groups are calling for collective

voluntary action, which is a start. But, if the growing number of regulations being considered at the federal, state and local levels is any indication, governments are getting impatient about the limited progress.

As stated earlier, many exciting

real estate deals are transforming our communities, thanks to the visionary leaders and entrepreneurial developers who are taking risks

and making calculated investments to sustainably repurpose existing and often obsolete property types. Why not plan to have your efforts recognized this spring by entering the NAIOP NJ’s Creative Deal of the Year contest. Winners to be

TM 25 announced the evening of May 18 at

the 36th Annual Commercial Real Estate Awards Gala at the Palace in Somerset, New Jersey. Entry forms will be available in early January at www.naiopnj.org and the deadline for their submittal is Feb. 3, 2023. For more information, contact [email protected].

MICHAEL MCGUINNESS is CEO of

NAIOP New Jersey and has led the commercial real estate development association since 1997. NAIOP represents developers, owners,

asset managers and investors of commercial, industrial and mixed- use properties, with 830 members in New Jersey and over 19,000 members throughout North America. RE

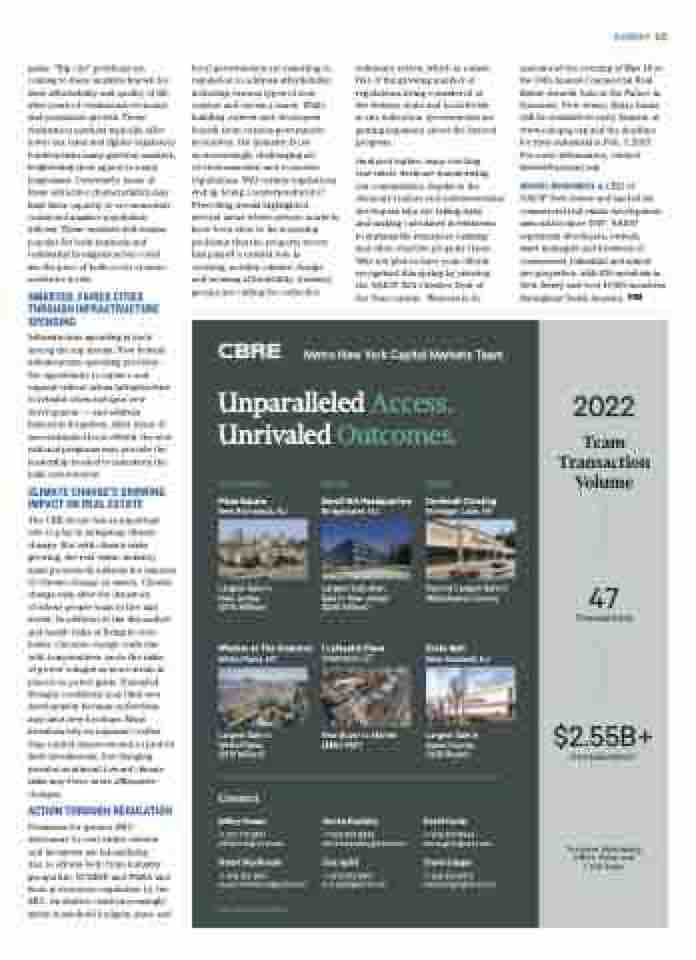

Metro New York Capital Markets Team

Unparalleled Access. Unrivaled Outcomes.

MULTIFAMILY

Plaza Square

New Brunswick, NJ

Largest Sale in New Jersey ($174 Million)

Windsor at The Gramercy

White Plains, NY

Largest Sale in White Plains ($113 Million)

Connect

Jeffrey Dunne

+1 201 712 5841 [email protected]

Stuart MacKenzie

+1 203 352 8917 [email protected]

OFFICE

Sanofi NA Headquarters

Bridgewater, NJ

Largest Suburban Sale in New Jersey ($261 Million)

1 Lafayette Place

Greenwich, CT

New Buyer to Market ($864 PSF)

Steven Bardsley

+1 203 352 8933 [email protected]

Eric Apfel

+1 203 352 8951 [email protected]

RETAIL

Cortlandt Crossing

Mohegan Lake, NY

Second Largest Sale in Westchester County

Essex Mall

West Caldwell, NJ

Largest Sale in Essex County (1031 Buyer)

David Gavin

+1 203 352 8944 [email protected]

Travis Langer

+1 203 352 8910 [email protected]

www.cbre.us/igtristate

2022

Team Transaction Volume

47 Transactions

$2.55B+ Consideration*

*Includes Multifamily, Office, Retail and Land Sales