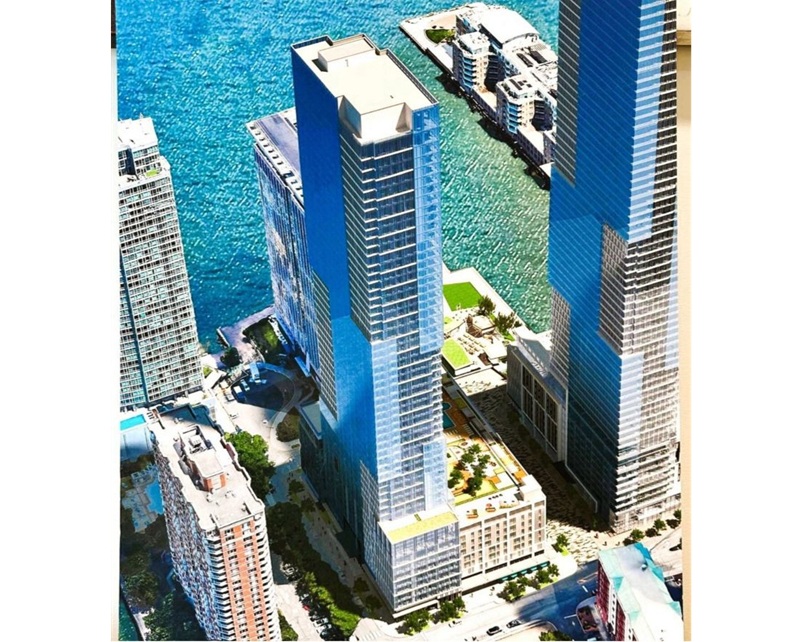

Plans for Harborside 9 in Jersey City call for a 57-story, 579-unit apartment tower with market-rate and affordable housing, 14,800 square feet of retail space and a 555-space parking garage. — Rendering courtesy: Jim Pompa / GN Management

By Joshua Burd

Panepinto Properties has sold one of two newly acquired development sites in Jersey City to GN Management, a fellow real estate firm based in the city, setting the stage for the latter to build a 57-story, 579-unit apartment tower alongside another planned high-rise.

The buyer, which is privately held, said Wednesday that it purchased full ownership interest in the Harborside 9 tract through affiliate and intercompany transfers. It now intends to begin work after what it described as minor site plan refinements, seeking to start development in 2027 on a project that will include market-rate and affordable housing, 14,800 square feet of retail space and a 555-space parking garage.

The building would rise alongside a 65-story, 678-unit tower at Harborside 8, which is the other site that Panepinto acquired recently and is now set to develop alongside AJD Construction. Cushman & Wakefield arranged the initial $75 million sale of the properties to Panepinto, from Veris Residential Inc., while Jim Pompa of Coldwell Banker brokered the ensuing trade of Harborside 9 to GN Management.

“Harborside 9 is a rare opportunity to advance meaningful housing supply on Jersey City’s waterfront, and we’re proud to take this project forward,” said Arvinder Singh Minhas, president of GN Management. “We’re grateful to Panepinto Properties for their collaboration and to Jim Pompa for helping bring the right partners together at the right time.”

According to a news release, the Harborside 9 deal included a transfer of the remaining Harborside 9 development rights and ownership held by Panepinto. GN Management added that Pompa “aligned the parties and helped ensure progress of the broader development timeline” to ensure both phases “can move forward on essentially similar timeframes.”

The developer added that the 15 percent affordable housing component at Harborside 9 will create 87 homes for low- and moderate-income renters, helping to chip away at an ongoing housing crisis in the region.

“This deal required patience, creativity and trust, and ultimately brought together highly respected groups who believe in the future of Jersey City,” Pompa said. “I’ve spent more than a decade focused on this market, and I’m committed to helping advance projects that strengthen neighborhoods and create long-term value. GN Management is exactly the kind of partner you want stepping into a site like this.”

Bravo Capital supported GN Management’s acquisition of Harborside 9 with the help of finance broker Vivek Jagadish of Blue Mountain Capital. The law firm of Castano Quigley Cherami LLC represented GN in both the acquisition and financing transactions.

“Jersey City remains one of the most resilient and opportunity-rich markets in the region,” said Onkar Singh, CEO of GN Management. “We are proud to invest here and are confident Harborside 9 will reflect the community’s energy, diversity and momentum.”