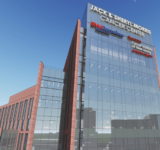

Jersey City Urby — Courtesy: Mack-Cali Realty Corp.

By Joshua Burd

Mack-Cali Realty Corp. is set to open the doors to a new 762-unit apartment tower in Jersey City and is pushing ahead with a $1 billion multifamily construction pipeline, the company said, as it finalized a plan to raise $300 million for acquisitions in the high-end rental space.

The company on Monday announced a flurry of activity involving the apartment sector and its Roseland Residential Trust subsidiary. That includes the delivery of 1,163 luxury units to the region since the beginning of the fourth quarter of 2016, including the 69-story waterfront tower known as Jersey City Urby, which the company will open for leasing on Tuesday.

Another new building in Jersey City, the 311-unit M2 at Marbella, ended the year at 95.5 percent leased after absorbing about 50 apartments per month through November, Mack-Cali said in a news release. Overall, Roseland’s stabilized residential portfolio was 96.3 percent leased at year-end 2016.

The company also had 2,691 apartments and 372 hotel rooms under construction through the start of the 2017, representing nearly $1.1 billion of activity, with stabilized net operating income projected at $75.8 million, the news release said. This activity included several starts of projects in which Roseland is repurposing former commercial properties in Mack-Cali’s vast footprint.

For instance, at 233 Canoe Brook Road in Short Hills, Roseland has started site work on a 200-apartment community, the news release said. The property is adjacent to a future hotel development site and Mack-Cali’s 150 JFK Parkway office building.

Also on Monday, Mack-Cali announced the signing of a $300 million equity raise with affiliates of Rockpoint Group LLC, a Boston-based private equity firm. The company said the deal “will provide capital to further execute on the objectives of Roseland’s residential business plan,” with a commitment from Rockpoint to fund $300 million of equity into Roseland Residential Trust over the next two years, including a $150 million infusion at closing.

“I am very pleased with the Roseland team’s great performance in 2016 led by Marshall Tycher and Andrew Marshall who created a great platform of current assets and a superb pipeline of new developments,” Michael J. DeMarco, Mack-Cali’s president, said in a prepared statement. “That excellence has led us to Rockpoint becoming our strategic partner.

“I have worked with Rockpoint before when I was at Vornado and they are a class act in everything they do and a superb fiduciary for their fund,” DeMarco added. “We look forward to having great success in the upcoming years with them as our partner.”

The full terms of the Rockpoint transaction are available on Mack-Cali’s website.