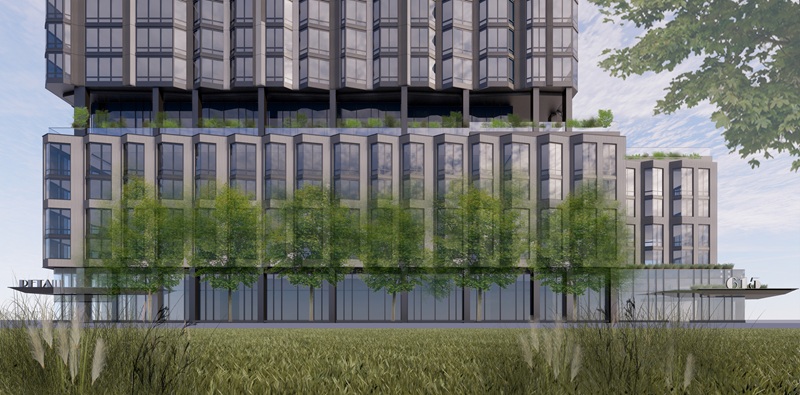

The first phase of a project by The Maxal Group will bring a 25-story, 381-unit apartment tower to 615 River Road in Edgewater. — Renderings by FXCollaborative/Courtesy: S3 Capital

By Joshua Burd

The Maxal Group has closed on a $255 million construction loan for a planned 25-story, 381-unit apartment tower at a long-vacant and well-known parcel along the Hudson River in Edgewater.

The lender, S3 Capital, announced the deal last week while noting that it will finance the first phase of a $1 billion mixed-use development at 615 River Road. The new apartments will be among more than 1,200 homes that are slated for the site, where plans also call for more than 1,000 parking spaces, ground-floor retail space and a new public ferry terminal with direct service to Manhattan’s West Side.

Galaxy Capital brokered the transaction.

“We see immense opportunity in financing transit-oriented residential developments adjacent to major city centers,” said Steven Jemal, managing director of origination with S3 Capital. “This project’s innovative on-site ferry terminal will create lasting value for the entire Edgewater community, and we look forward to supporting The Maxal Group throughout the construction process.”

The financing is the latest step forward for a project that is more than a decade in the making and would revitalize a former Hess oil terminal site opposite New York City. A joint venture led by The Maxal Group acquired the roughly 18-acre property in 2014 but spent several years in a legal battle with the borough over delays in the redevelopment process, citing officials’ ties to rival and now-disgraced developer Fred Daibes.

The dispute, which was detailed in last year’s corruption trial for former U.S. Sen. Bob Menendez, ended in 2019 with a settlement between the Maxal venture and borough officials. The pact called for the developers to remediate the site and improve transportation access, allowing them to build up to 1,200 units of market-rate and affordable housing while donating some eight acres to Edgewater for a new school and open space.

In last week’s announcement, S3 noted that the new ferry terminal will provide residents with direct access to Manhattan’s West Side and the Hudson Yards tech pocket in under 15 minutes. It will also have on-site stops with access to NJ Transit bus routes with service to the Port Authority Bus Terminal.

“We are thrilled to partner with The Maxal Group as they develop a transformative project that will bring much-needed state-of-the art housing and transit access to the Edgewater waterfront,” said Shawn Safdie, also a managing director with S3 Capital. “This transaction reflects our commitment to supporting best-in-class developers delivering new product to undersupplied markets.”

The firm said the project, designed by FXCollaborative, will have a notched glass-and-corrugated façade that evokes the nearby Palisades. CetraRuddy designed the building’s luxury interiors, which will complement more than 25,000 square feet of high-end indoor amenities and a host of outdoor spaces.

“We are extremely excited in working with S3 to bring another cutting-edge environment to the Hudson River waterfront,” said Bruce Sturman, The Maxal Group’s founder and managing director. “615 River will be an extraordinary living experience with stunning Manhattan and George Washington Bridge views via floor-to-ceiling glass in units that set itself apart from existing rental product in the marketplace.”

The developer, which has also built the 236-unit Harbor 1500 building in neighboring Weehawken, will also construct a 2.5-acre public waterfront park with 650 feet of river frontage. The space will become part of the Hudson River Waterfront Walkway, an 18.5-mile-long promenade that runs from Fort Lee to Bayonne.

S3, a private lender, said it has originated more than $7 billion across over 750 bridge and construction loans for middle-market residential developments. The firm this year has also opened new offices in Texas and Florida.

“Our strategic expansion in key markets across the country strengthens our position as one of the leading private construction lenders in the U.S.,” S3 Capital Co-Founder Robert Schwartz said. “Our ability to underwrite with precision, deploy capital quickly and bring in-house construction expertise to each project enables developers to successfully execute time after time.”