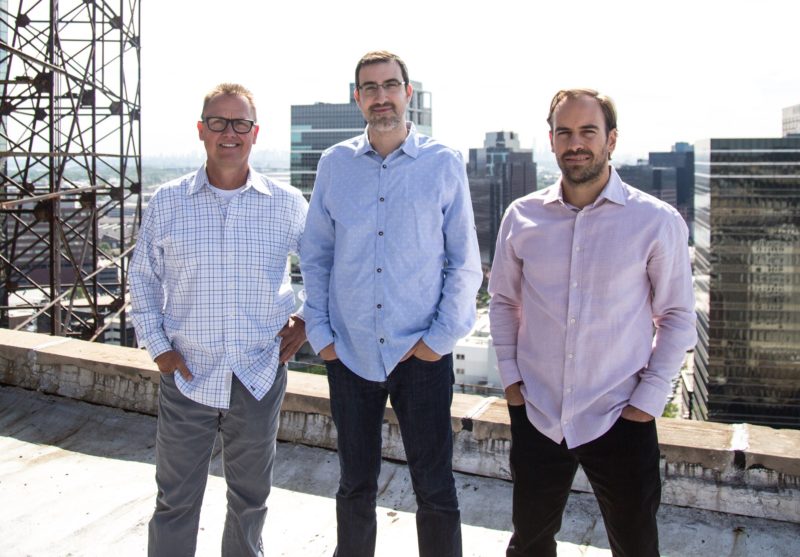

From left: Andy Wallace, Ron Kutas and Nate Kline are the founders of One Wall Partners, a real estate investment and management firm focused on workforce, transit-oriented housing in northern New Jersey and other major markets. — Courtesy: One Wall Partners

By Joshua Burd

One Wall Partners, a Newark-based owner of transit-oriented workforce housing, has expanded its portfolio with the acquisition of nearly 1,000 apartments in eastern Pennsylvania.

The investment and management firm announced this week that it acquired four properties spanning 996 units in the Lehigh Valley. The portfolio, which stands at 98 percent occupancy, features three large garden complexes and a rental townhome community in areas that are home to new development and anchors in the health care, education and corporate sectors.

One Wall did not disclose the purchase price, the address of the properties or the seller’s name, although published reports have identified Lone Star Funds as the other party. The properties traded for a reported $180 million.

One Wall did not disclose the purchase price, the address of the properties or the seller’s name, although published reports have identified Lone Star Funds as the other party. The properties traded for a reported $180 million.

“The Lehigh Valley portfolio provides enormous opportunity for renters seeking a central location with close proximity to employment, arts, and entertainment,” said Andy Wallace, CEO and principal of One Wall Partners. “These assets perfectly complement our existing portfolio of transit-oriented workforce housing, and we look forward to increasing their value by enhancing services and amenities for residents.”

The firm, which owns and operates more than 3,600 units of rental housing in the region, noted that the Pennsylvania properties feature amenities such as outdoor pools, fitness centers and clubhouses. Renters also have easy access to the LANTA mass transit system and multiple highways connecting them to Pennsylvania’s and New Jersey’s largest employment hubs.

“We’ve aligned ourselves with strategic equity partners that support our value-add capex plan and recognize the upside in these markets,” said Nate Kline, CIO and principal of One Wall Partners. He noted that the firm plans to spend more than $500,000 on energy efficiency upgrades and deferred maintenance, plus up to another $5 million “to maintain the high quality of the properties and upgrade hundreds of units over time.”

The Lehigh Valley is the fastest-growing and third-most populous region in Pennsylvania, Kline added, with almost 700,000 residents. He also noted that the region generates higher economic output than 112 individual countries.

“It is also a strategic manufacturing and transportation hub in the middle of the Northeast metropolis that is anchored by thousands of stable jobs in medicine and education,” he said. “The diverse workforce is educated and majority renter-based. We view this region, where we have swiftly become one of the largest owner-operators, as a long-term growth market for us.”

One Wall Partners was represented in-house, while CBRE represented the seller and arranged financing for the transaction with Freddie Mac and MF1, a joint venture led by Berkshire Residential Investments and Limekiln Real Estate.