Denholtz Properties President Stephen Cassidy (left) and Chief Operating Officer Greg Brown are leading the effort to streamline the operations of the development and real estate investment firm and weave technology into virtually every facet of its business. — Photo by Aaron Houston for Real Estate NJ

By Joshua Burd

It’s been more than five years since Denholtz Properties dipped its toe into the world of crowdfunding, a tool that was in its infancy when it came to commercial real estate.

These days, the firm sees it as an essential piece of its capital stack — with a pool of some 800 accredited investors using the online platform known as CrowdStreet. What’s more, Denholtz has used the platform to create a detailed portal for each investor in its portfolio — one that’s accessible at any time.

“Every investor we have, whether we raise the money on CrowdStreet or not, is funneling through that technology,” said Stephen Cassidy, the president of the Red Bank-based firm. “So I wanted those groups to feel like they had a Merrill Lynch account, (where) on a Sunday night they could go see their investment, they could understand what their project was doing.”

For Denholtz, it’s one piece of a strategy to modernize the company and weave technology into virtually every facet of its operation. The plan has been ongoing for nearly a decade, Cassidy said, with a focus on creating transparency for its investors, efficiency as a business and the flexibility to scale its portfolio.

That focus only grew in 2020 and serves to differentiate Denholtz from other companies of its size, Cassidy said, noting that the firm has about 65 employees and is approaching $1 billion in capitalization — with ambitions to grow.

“It’s really been a march for a long time,” said Cassidy, who leads the company alongside CEO Steven Denholtz. “Not toward a destination, but just really a continual evolution.”

The business took another key step to that end in early 2020 when it hired Greg Brown, a veteran industry executive, as its chief operating officer. Since then, Brown has carried Cassidy’s message of “flattening the organization” through the use of integrated, centralized access to information on Yardi, VTS and other platforms that help the firm manage its portfolio.

“(It’s) using technology to shorten the distance between data and decision-maker,” said Brown, who joined Denholtz last January from NAI DiLeo-Bram & Co. So if the firm needs to make a decision on a particular asset, its executives don’t have to chase multiple people “to figure out what the real, on-the-ground situation is.”

“We’ve got visibility to that with two clicks.”

As Cassidy tells it, the firm’s focus on technology began in late 2012 after Hurricane Sandy. The storm left Denholtz without power or access to its office, which was in Matawan at the time, exposing its vulnerability and a lack of redundancy within the organization.

“We were essentially out of business for two full weeks, and then it was basically some sort of hybrid model another month,” Cassidy said. “(It was) very challenging to do business and collect your money, pay your vendors and that type of thing.”

That led the firm to pivot to the software-as-a-service model — using third-party, cloud-based platforms — which he concedes “is pretty costly, but Denholtz Properties it really just brings to an organization mobility and the ability to communicate with one another wherever you are.”

Denholtz continued its IT overhaul in 2019 when it moved its headquarters to Red Bank, buying all new computers for its employees and “(starting) everyone fresh with the same basic package of technology.”

The pandemic and the need for flexible work solutions have only accelerated that transition. In 2020, the firm set out to implement the full suite of Microsoft Office products. Chief among them was SharePoint — a web-based platform for collaborating, managing documents and other functions — which has allowed it to create an intranet and a digital “home base” for everyone across the organization. That followed the introduction of Microsoft Teams, the videoconferencing application, nearly two years ago.

“Everybody has always talked about a paperless world,” said Cassidy, who credits Christina Jordan, Denholtz’s director of marketing and leasing, with sourcing much of the firm’s technology. “For the first time in my career, I feel like (we’re) close to that endeavor. We have the ability to see what’s going on in our company in a dashboard style-environment at any time.”

As for hiring Brown as COO, Cassidy said the firm ran “a pretty lengthy process to make sure we saw the market of people who could help us. But I knew from the beginning that Greg, because of our previous acquaintance, had a similar style to me and was all in on making a company tech-heavy and on making technology be the focus of how you run the company.”

Brown is also attuned to those innovations that are specific to real estate — so-called proptech, for property technology — including crowdfunding. That has only bolstered the firm’s expertise in a platform that it has used for more than five years, after the federal Jumpstart Our Business Startups Act of 2012 loosened decades-old restrictions on how businesses could raise capital. To date, Denholtz has funded some part of 10 deals using CrowdStreet.

Cassidy believes the technology is here to stay.

“It’s really transformational in the industry as to how we all respond and react to investors, but also how investors find real estate,” Cassidy said. He added that the platform also provides a place for both sponsors and investors to compare deals and their potential returns.

“There’s a true marketplace being built that really never existed, not even five years ago.”

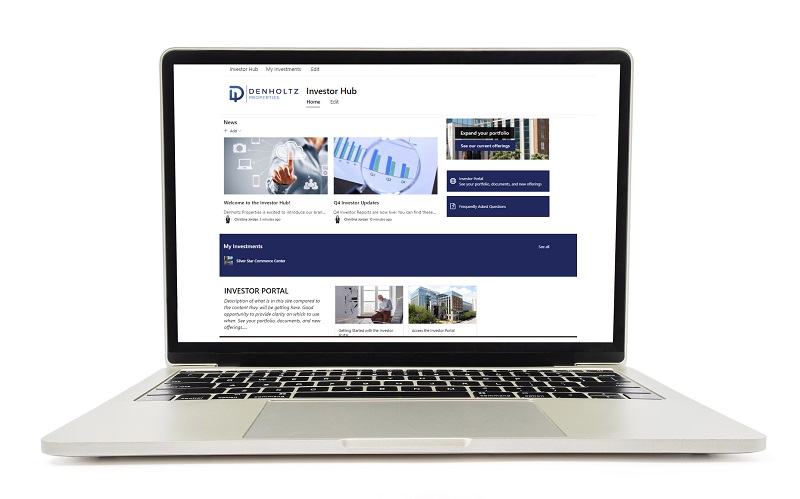

Denholtz has seen the value of bringing information directly to its investors. It’s now set to launch a new, interactive investor hub on SharePoint that will provide real-time updates on projects, including photos and news on items such as capital improvements, along with quarterly updates including financial results, market information and webinars.

Cassidy believes providing that type of visibility will make Denholtz unique among other companies of its size, while creating trust with the still-growing segment of online investors.

“That’s really what the demand is in the market for people to want to continue to do business with you — they don’t know you, they don’t understand what you do for a living,” he said. “They know you’re running real estate, so the closer you can bring them to that real estate through real photographs and videos, the better off you’ll be.”

Denholtz also manages its portfolio with tools such as Yardi, the popular lease administration and accounting software. The company has not only used the program for some two decades, but it has spent the money in recent years to integrate it with other platforms such as Procore, the leading construction administration software, in another step to streamline its operations and create additional transparency.

Brown said the willingness to make that investment is another differentiator. He believes many real estate firms are slow to adopt technology “because the decision-making becomes a little bit overwhelming” — namely when it comes to how quickly the platform will become outdated or how it will integrate with an existing system.

Others fall into the trap of looking for an immediate or direct return on investment, he said, but Denholtz sees the value of having a holistic, interconnected approach to technology.

“Sometimes it’s not linear like that,” Brown said. “You just have to have the confidence that this allows us to have better visibility into property performance and that makes us better stewards of real estate investors’ money.”

Technology will also be key as the company grows its development pipeline and expands its geographic footprint. With a longstanding presence in Central Florida, Denholtz is also looking at opportunities along the Interstate 85 corridor in North Carolina, with an eye toward submarkets such as Charlotte and Raleigh-Durham.

Having consistent protocols and systems across multiple offices, with the ability to access key information from anywhere, will be critical to its growth.

“When Greg got here, that was it,” Cassidy said. “(We said) we’re going to build something that you can replicate wherever you are and it’s the same whether you’re sitting here in New Jersey or Florida or North Carolina.”

Crowdfunding in real estate? Industry experts make their case