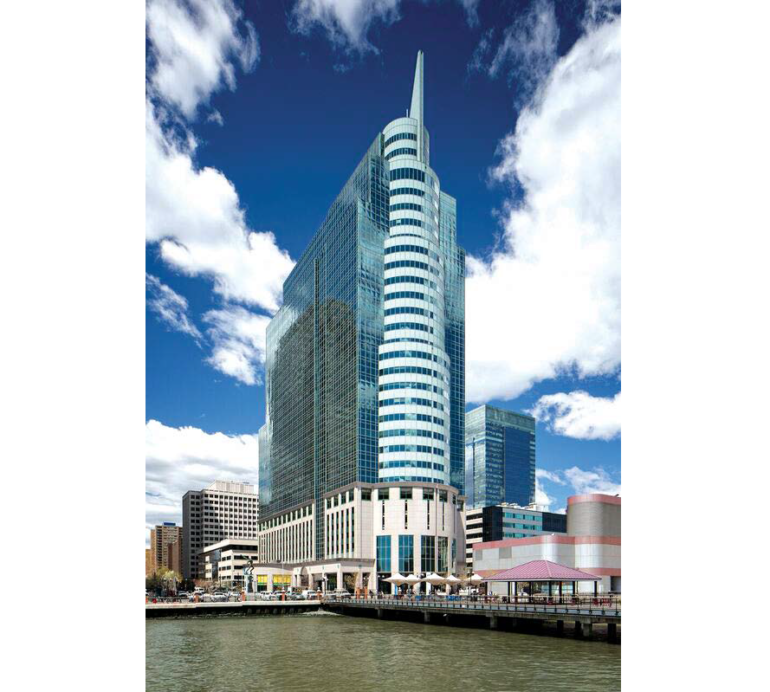

10 Exchange Place in Jersey City — Courtesy: Manulife US Real Estate Investment Trust

By Joshua Burd

A real estate investment trust will pay $313 million for a Jersey City office tower, the company said, marking its second major acquisition in the state in two months.

Manulife US Real Estate Investment Trust, which is listed in Singapore, has agreed to buy the 731,000-square-foot 10 Exchange Place from John Hancock Life Insurance Co. The REIT said the 30-story tower is 93 percent leased, with tenants including Amazon Corporate LLC, ACE Insurance Co., Rabo Support Services Inc. and nearly two dozen others.

The deal comes two months after Manulife US REIT acquired 500 Plaza Drive, an 460,000-square-foot office building in Secaucus, for $115 million. Through July, the REIT said its portfolio spanned some 2.2 million square feet and was valued at more than $970 million.

“We are delighted to acquire this flagship asset a stone’s throw from New York City,” said Jill Smith, CEO of Manulife US Real Estate Management Pte. Ltd. “This acquisition demonstrates our ability to grow inorganically through the addition of another yield accretive property at the right price.”

Manulife US REIT is affiliated with the Canadian insurance giant Manulife Financial Corp. Meantime, John Hancock is unit of Manulife operating in the U.S.

John Hancock acquired 10 Exchange Place in 2011 for $285 million.