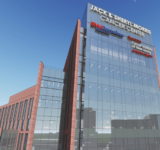

Cranbury Station Park in Cranbury, a new 930,000-square-foot distribution center built by the Rockefeller Group and Alfieri LLC — Courtesy: The Rockefeller Group

By Joshua Burd

Just how big is the impact of e-commerce on New Jersey’s industrial market?

A series of high-profile deals, along with research by a top real estate services firm, shows that the demand from such users is overwhelming in the Garden State. And it shows no signs of abating, as online retail businesses and on-demand food services only continue to grow.

A report by CBRE found that, over the last three years, 35 percent of all new lease commitments of 250,000 square feet or greater in New Jersey were signed by companies that deliver goods directly to consumers. Experts say the trend continues to be driven by fundamentals such the state’s port infrastructure, its highway access to the country’s largest consumer market and the ability of developers to build modern-generation space for e-commerce users.

That all ties to another finding by CBRE’s Saddle Brook office. Scott Belfer, a senior vice president with the firm, said he was tracking more than 5 million square feet of e-commerce requirements in the market right now, including many “household names” in the sector.

New Jersey’s industrial developers are racing to keep up with the demand.

“There’s a lack of existing availability of newer-construction buildings,” said Scott Belfer, senior vice president with CBRE. “And it’s forcing some of these larger users to still look in the Jersey market, but they’re looking at build-to-suit options. So they need to go look at buildings that have been pad-ready or planned, but they’ve not yet been constructed.”

“It’s also making them look at existing product that might be second-generation.”

For instance, Amazon has satisfied its need for another million-square-foot fulfillment center here by retrofitting a building in Carteret. The company also leased another roughly 618,000 square at a decades-old warehouse in Teterboro earlier this year, allowing it to be less than 10 miles from the George Washington Bridge into Manhattan.

But many other e-tailers are rewarding speculative developers who have started new big-box industrial projects in New Jersey. The biggest example is Wayfair, which leased 1.24 million square feet in Cranbury at a site developed by The Rockefeller Group and Alfieri LLC.

The 14-year-old company, which focuses on home improvement goods, will occupy a 930,000-square-foot distribution center that has been completed just off New Jersey Turnpike Exit 8A. Wayfair has also committed an adjacent 311,000-square-foot building that will be open by mid-2017.

“From the very start, we received a significant amount of interest in Cranbury Station Park,” Michael Alfieri, president of Alfieri, said in a prepared statement. “Not only is the building exceptionally well-located, but several of the property’s key features — including its 40-foot clear height — allowed us to stand out from the rest and ultimately attract a major player in the e-commerce space to the building.”

Other major e-commerce leases in New Jersey this year include:

- Amazon (810,000 square feet) at 380 Middlesex Ave. in Carteret

- Blue Apron (495,121 square feet) at 901 West Linden Ave. in Linden

- HelloFresh (352,000 square feet) at 60 Lister Ave. in Newark

- Boxed (144,000 square feet) at 750 Union Ave. in Union

To keep pace, Garden State developers have delivered 16.5 million square feet of new industrial space to the market over the past five years, CBRE found. And there is a pipeline of another 5.24 million square feet across 19 properties.

The largest among them include Seagis Property Group’s speculative 923,000-suqare-foot distribution center in Edison, which broke ground last spring. In Perth Amboy, Bridge Development is building a 718,000-square-foot facility that will anchor a three-building, 1.3 million-square-foot logistics complex minutes from the Turnpike.

Belfer said there is plenty of demand for such big boxes in the state. Of the 5 million square feet of e-commerce requirements in the market, he said there are a half-dozen that are seeking at least 500,000 square feet.

The others range from 100,000 to 500,000 square feet, Belfer said. But they’re often looking for the same features that their larger counterparts need: large cross-dock facilities, abundant car and trailer parking and ceilings as high as 36 or 40 feet.

“Once you start looking at buildings between anywhere from (250,000 to 700,000 square feet), some of these users are looking at putting in multilevel mezzanines so that they can pick and pack smaller products,” he said. “And, ideally, you’re utilizing the height of the building to gain more square footage instead of going out on the floor and doing it there.”

At a glance: Wayfair’s lease in Cranbury

- Size: 1.24 million square feet

- Landlord/developer: The Rockefeller Group and Alfieri LLC

- Submarket: New Jersey Turnpike Exit 8A

- Brokers: Stan Danzig, Jules Nissim and Stephen Elman of Cushman & Wakefield exclusively represented the developers, while Jon Varholak of Transwestern represented the tenant.

- Completion dates: Building one is complete. Building two will be completed in mid-2017

Known as Cranbury Station Park, the property sits on a 120-acre parcel along Cranbury Station Road and includes 40-foot clear ceiling height, a solar-ready roof, cross-dock loading and a loop road surrounding the entire building to maximize circulation, Rockefeller said. The complex is designed to LEED Silver specifications and is eligible for a Foreign Trade Zone designation.

“With each and every one of our projects, we strive to anticipate market demand and deliver the highest quality product that will set the standard for the rest of the industry,” Clark Machemer senior vice president and regional development officer for Rockefeller, said in a prepared statement. “Cranbury Station Park, situated among the nation’s top industrial hubs, is no exception to this.”