By Joshua Burd

Developers and owners have reaped the benefits of rent growth in New Jersey’s surging industrial market, but they’ve also scored big with increasingly longer lease terms.

That’s according to new research from CBRE, which found that landlords have been able to secure longer leases amid the lack of supply in northern and central New Jersey. The findings show that lease terms for space greater than 250,000 square feet have increased 24.8 percent since 2013, along with 15.3 percent for spaces between 100,000 and 250,000 square feet.

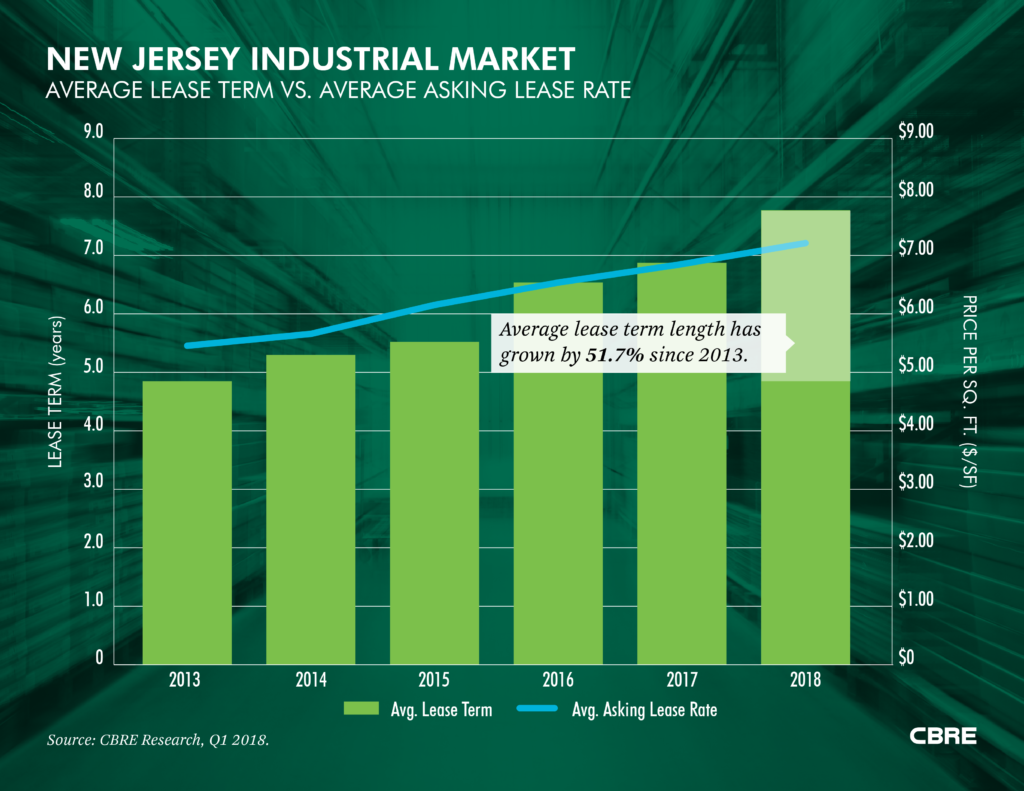

Overall, CBRE found that average lease terms in the region have grown from around five years in 2013 to nearly eight years through the first quarter of 2018.

While tenants prefer shorter-term deals and flexibility, owners continue to have the upper hand when it comes to negotiating on warehouse and distribution space in the Garden State.

“You have a lot of very large users that have been in the market,” said Steve Gardner, senior research analyst with CBRE. “Despite the fact that new construction has been very strong and we’ve had a lot of deliveries, what’s happened is that demand has continued to outstrip supply, particularly in the last couple of years, so landlords are in the driver’s seat.”

That demand is being fueled by the increasingly large requirements of e-commerce and other users, increased volume at the Port of New York and New Jersey and an overall healthy economy, Gardner said. CBRE Research Coordinator Zack Myers added that the demand has also come from third-party logistics users and other sectors across the tenant pool.

There are few signs, if any, that those trends will disappear in the near future, so tenants will likely remain cognizant of the competition for space.

“Tenants may also feel that, as much as their natural tendency would be to go shorter or go more flexible, they’re also trying to make sure they have these spaces locked down,” Gardner said.

The demand has also equated to sustained rent growth in northern and central New Jersey: CBRE found that the average asking lease rate has increased from around $5.50 to more than $7 per square foot as of Q1. Developers are now racing to capitalize on the demand, Myers said, as CBRE tracks more than 13 million square feet of space under construction in the state.

It’s a significant pipeline, Gardner and Myers said, but the need is such that owners in the near future will likely continue to achieve both rent growth and increasing lease terms.

“It just depends on when we reach that saturation point and that will be indicative of when we start to see a change,” Myers said. “But for now, nobody wants less space for less time at this point.”