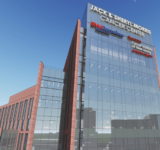

Ocean Resort Casino in Atlantic City (Shutterstock)

By Joshua Burd

An existing shareholder is leading the $70 million capital infusion into the Ocean Resort Casino in Atlantic City, paving the way for it to become the property’s new majority owner.

AC Ocean Walk, which acquired the soaring beachfront property last January, announced Monday that the New York-based private investment firm Luxor Capital Group would lead the new investment. The operator has struggled to gain market share in the city since reopening the former Revel Casino Hotel, but said the new investment will fund a series of upgrades for 2019 and provide the property with greater financial flexibility.

The investment is expected to close in early February, pending regulatory approvals. Bruce Deifik, a Colorado-based developer who led last year’s acquisition, will retain a minority stake.

“We are incredibly proud of the progress our team members have made in establishing Ocean Resort Casino as one of the premier gaming and leisure destinations in the United States,” said Frank Leone, CEO of Ocean Resort Casino. “We opened up the property even more effectively to the Boardwalk, and activated retail spaces and food and beverage options that have been extremely well-received by our guests.

“We are thankful for the support we have received from the broader Atlantic City and New Jersey community and look forward to an exciting 2019.”

The news comes a year after AC Ocean Walk acquired the resort property from developer Glenn Straub, who had acquired the shuttered casino out of its second bankruptcy. Originally completed in 2012, the $2.4 billion megaresort closed after just two years and sat unused until AC Ocean Walk reopened it last summer.

The group has completed a major renovation of the 6.4 million-square-foot property, partnered with Hyatt and added new amenities such as a William Hill sports book and a new Topgolf full-swing golf simulator. In 2019, ownership said it plans to add a buffet, expand its stock of suites and rooms and make new investments on the casino floor.

Luxor Capital Group has no current or past affiliation with the Las Vegas property known as Luxor. Its new investment will increase its ownership to a controlling level, requiring it to complete a licensing process that could take 90 to 120 days.

In the meantime, AC Ocean Walk said a trust will be created for the purpose of holding the shares of the parent entity. A trustee, who will be appointed upon closing of the $70 million investment, will oversee the trust until Luxor receives its interim authorization, at which point the trustee will be removed.

Ocean Resort Casino expects no operational effects from the temporary existence of the trust, according to a news release.