A joint venture of Advance Realty Investors and CrossHarbor Capital Partners LLC recently sold The New Jersey Center of Excellence, a seven-building, 784,000-square-foot R&D and office complex in Bridgewater, to Thor Equities for $152 million.

By Joshua Burd

A joint venture is reaping the rewards of a plan to reposition a sprawling research and development complex in Bridgewater, having sold the campus for more than $150 million.

All the while, the deal has cast a light on the allure of life sciences as a real estate investment class and the power of collaboration by brokers across multiple geographic markets.

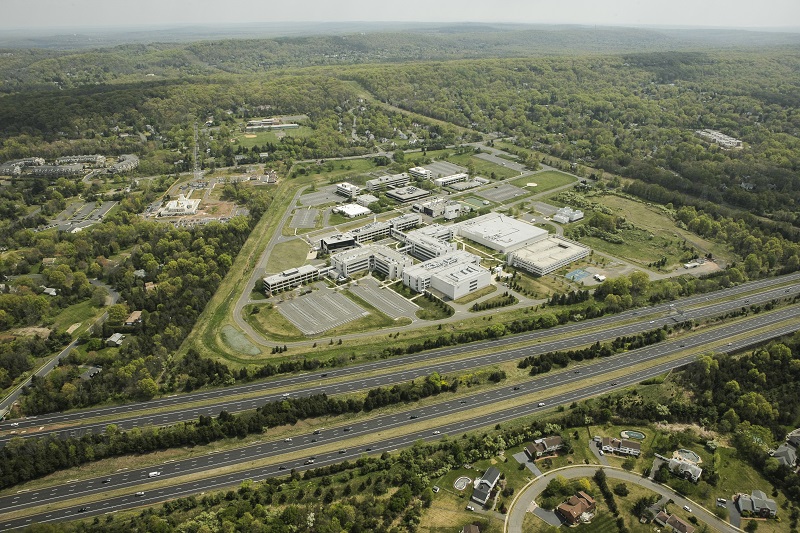

The well-known campus, The New Jersey Center of Excellence, is a former U.S. research hub for the French pharmaceutical giant Sanofi. The joint venture of Advance Realty Investors and CrossHarbor Capital Partners acquired the site in 2014 — helping to backfill a trove of existing lab and office space and attracting Nestlé Health Science, among others — before selling the 784,000-square-foot complex to Thor Equities in early August.

“The ultimate measure of the repositioning is executing a sale at this level,” said Kevin Welsh, an executive managing director with Newmark Knight Frank, who was part of the team that marketed the property at 1041 Route 202/206. The seven-building complex sits on 48 acres within a 110-acre property, he said, noting that Advance and CrossHarbor still own the balance of the site and are pursuing a mixed-use component.

For Thor Equities, a New York-based developer and investor, the acquisition is part of a high-profile push into real estate that is tied to life sciences and R&D. The company announced the $152 million acquisition in conjunction with the launch of a platform called Thor Sciences, which is betting on medical advances, an aging population and an influx of venture capital to drive demand for such space.

In Bridgewater, the company is planning tens of millions of dollars in improvements that will expand the complex’s amenities and add more than 1 million square feet of laboratory space, in hopes of attracting additional companies.

“We have recognized the demand for research and development space has intensified and that there is a shortage of space in the New Jersey area,” said Joseph Sitt, Thor’s chairman and CEO. “The Center of Excellence already boasts an impressive roster of tenants and we plan to add more square footage to accommodate the demand.”

Other tenants at The Center of Excellence include Ashland Inc. and Amneal Pharmaceuticals, which anchor the campus alongside Nestlé Health Science’s headquarters and product technology center. Welsh noted that, together, the three companies occupy two-thirds of the leasable area and account for 74 percent of the revenue at the campus, with a weighted average lease term of 10 years.

That stability was a key selling point as NKF set out to market the property on behalf of Advance and CrossHarbor, as Welsh’s Rutherford-based team joined forces with the firm’s Boston-based capital markets group. The veteran broker called the partnership “a perfect fit because we had the local knowledge,” while the Boston-based team, led by NKF’s Rob Griffin, brought its expertise in life sciences.

That expertise comprised an understanding of not only the economics of life sciences as an asset class, but of the technical side of the industry. Griffin’s team also brought an existing relationship with CrossHarbor, which is based in Boston, while Welsh’s team leveraged its relationship with Advance.

“It’s really the power of this platform to be able to work together across clients but, as importantly, across the areas of expertise,” said Welsh, who joined NKF in spring 2017 to help expand its capital markets team in New Jersey. “And it’s a business of expertise. You need to have these skills because it does get granular and because the investors are very sophisticated and want to talk about ‘What are these companies doing in that space?’ ”

The Center of Excellence is also home to roughly a dozen other tenants in the pharmaceutical and biotechnology fields, which occupy anywhere from 2,000 to 30,000 square feet. Those tenants — which include ventures such as Insmed, Nevakar, Clinical Genomics and Vertice Pharma — represent the ongoing strength of New Jersey’s life sciences industry, despite years of consolidation by Big Pharma.

The companies also demonstrate the upside that prompted Advance and CrossHarbor to buy the campus in 2014, two years after Sanofi shuttered the R&D hub. The property offered state-of-the-art lab and production space that was move-in ready for emerging life sciences firms, along with infrastructure such as substations and backup power that would cost more than $1,000 per square foot to build.

A lease-up effort led by Advance and JLL has attracted many of those companies over the past five years and has helped stabilize the complex, which is now 86 percent leased. But Welsh also cited the upside that comes with filling the vacant space, especially given that existing rents are 23 percent below market.

“We did have all of the household names look at this,” Welsh said. “If you look at the institutions that are buying life sciences, they all looked at it.”

Such opportunities are rare, he added, making life sciences a highly competitive niche for those that venture into the space. Those that considered The Center of Excellence included buyers that are accustomed to buying in the Boston-Cambridge market, along with the San Francisco Bay Area, Raleigh and San Diego.

Sitt said the property was on Thor’s radar for more than a year prior to its acquisition, which he called “a major milestone for the Thor Sciences platform.” The company, which has long focused on retail and office space, has begun to acquire life sciences assets in major research hubs such as Boston and Berkeley, California, and has hired industry veteran Bill Hunter to lead its life sciences team.

Adding to the appeal of the Bridgewater campus is New Jersey’s highly educated workforce, its location along the Northeast corridor and the state’s network of colleges and universities. That’s not to mention Advance and CrossHarbor’s ongoing plans for the balance of the former Sanofi property. The joint venture, which declined to comment for this story, in recent years has pursued approvals for a mixed-use plan that would include some 400 residential units, along with retail, restaurants and a hotel.

The plan has encountered delays recently during the joint venture’s pursuit of entitlements. Even so, Sitt was bullish on the prospect and its ability to enhance Thor’s newly acquired asset.

“The further densification and development of residential, retail, and commercial space around the property reinforces the strength of the live-work-play dynamic,” Sitt said, adding that the plan “will positively impact the hundreds of industrious life science employees at the Center of Excellence.”

For the record

The Newmark Knight Frank capital markets team of Rob Griffin, Kevin Welsh, Matt Pullen, Brian Schulz and Jason Emrani represented Advance Realty Investors and CrossHarbor Capital Partners LLC in marketing the New Jersey Center of Excellence, a seven-building, 784,000-square-foot life sciences complex in Bridgewater. They also procured the buyer, Thor Equities.

NKF touts $152 million sale of Bridgewater life sciences campus