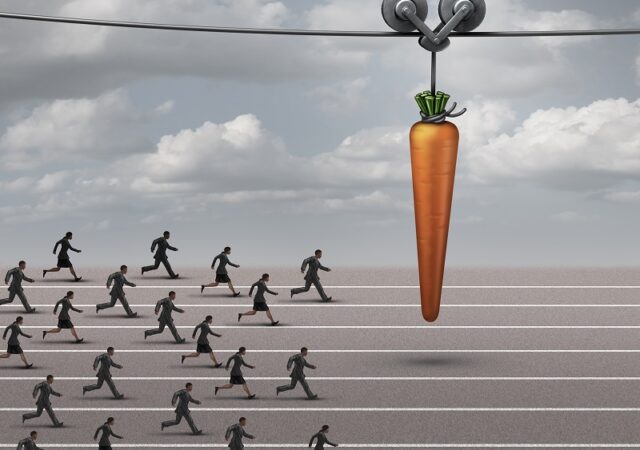

With the recent approval of the first awards under Emerge, the state’s new jobs-based tax incentive program, officials and other insiders expect to see a measured pace of applications for a subsidy that was designed to be more discerning and targeted than its predecessor.

Starting anew

The debate over New Jersey’s corporate incentive programs has been well-chronicled in recent years, but regardless of where you fall on the issue, there’s no denying their influence on the state’s commercial real estate market. That influence was all but gone for two years after Grow New Jersey and other subsidy programs were allowed to expire in summer 2019, with no immediate replacements in sight until Gov. Phil Murphy and lawmakers agreed on new incentives late last year. The state is now putting those offerings to work, starting with the jobs-based Emerge program that will fill the void left by Grow New Jersey.

Gridlock in Trenton: Not what investors want

Messaging from Trenton over the last several months, “airing dirty laundry” and delayed payments and responses to companies involved in the state’s incentive programs are scaring away legitimate businesses from setting roots in New Jersey. Businesses need certainty and clarity. Why don’t we pivot the conversation to one about how to make robust investments in our people and infrastructure without any further distractions and political roadblocks?