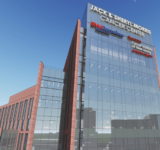

A rendering of the planned upgrades at 340 Mount Kemble Ave. in Morris Township, where Onyx Equities is planning a major redevelopment. — Courtesy: Onyx Equities

By Joshua Burd

After the success of 211 Mount Airy Road last summer, Onyx Equities found its next blank canvas about 10 miles away when it acquired 340 Mount Kemble Ave. in Morris Township.

Other developers had shied away from the opportunity. Aside from having 400,000 square feet of vacant office space, the property was sold through an online auction that required a nonrefundable deposit and did not allow would-be buyers to conduct due diligence.

It was the kind of bet that Onyx executives knew they could take.

“It’s an intimidating process,” said John Saraceno, co-founder of Onyx, “but if you have the internal confidence in your team and your group that we can do this, that process allows you to get a deal that you otherwise would have never gotten.”

The firm and its partners paid around $7 million for the vacant former AT&T property and, more importantly, the 40 acres beneath it. It has since kicked off plans to reposition the complex as a trophy office property that is six minutes from downtown Morristown, with major upgrades such as a new dramatic glass façade, a four-story atrium lobby, new amenity spaces and modern finishes.

For DJ Venn, who has led the effort to create a distinctive brand and experience across Onyx’s portfolio, the building offers the chance to do that in a way that surpasses anything the firm currently has.

“There haven’t been any tenants in the building in four years, so the sky is really the limit as to what we can do there,” said Venn, the firm’s senior vice president for asset management. “We can do anything we really want within a budget, so we will deliver that Onyx product there, I think, better than anywhere else we’ve done it.”

But Onyx is also developing concurrent plans that include a potential residential and hotel component at the property. Saraceno said “we have to adapt to whatever the market is” and possibly seek new zoning with local officials, which the firm knew full well when it acquired the site last summer. That uncertainty was one reason other developers passed on the deal, he said, but “the fact that, at the end of the day, we believed in it as an office building and we could absolutely operate it as an office building allowed us to buy it.”

“There weren’t a lot of people in our space that want to play that game,” Saraceno said. “We like that game. When there’s not a lot of people playing it, pricing drops, and the ability to actually buy it for a really good value happens.”