Sponsored Content

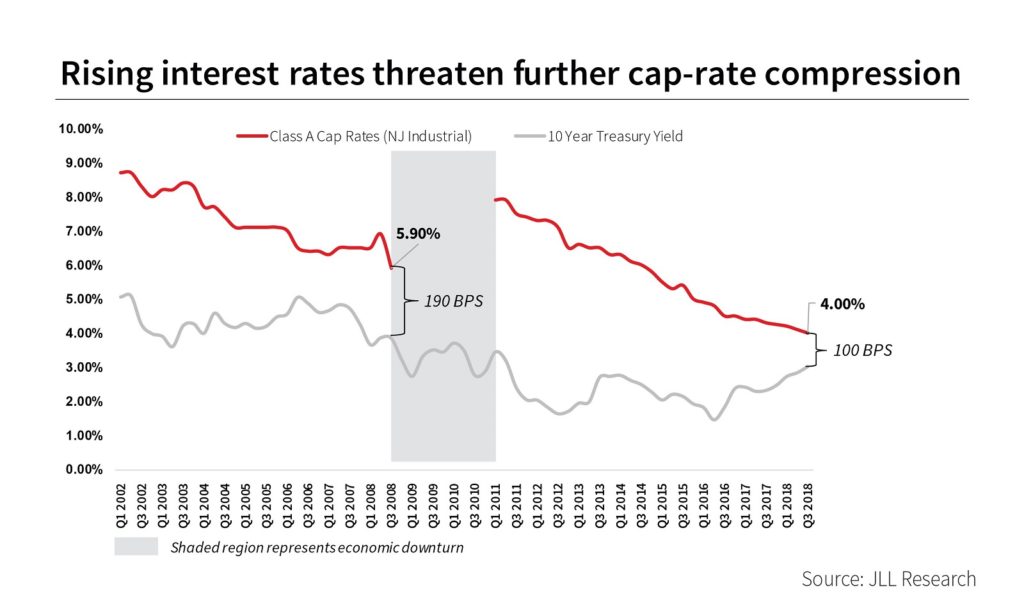

- Incredible fundamentals surrounding the New Jersey industrial real estate market has resulted in record investor demand, resulting in Class A cap rates steadily dropping since the end of the great recession to cycle lows, with some buildings trading with cap rates below 4.0 percent.

- Meanwhile, the Federal Reserve has raised interest rates three times (78 basis points) in 2018, bringing the spread between cap rates and US Treasuries to record lows.

- While the Fed has signaled fewer rate hikes in 2019, the recent rise in interest rates could act as a headwind to further compression. As a result, they expect a “leveling off” of cap rates, as they are expected to hover around the same level going into 2019. However, submarkets which have seen outsized rent growth could continue to see moderate compression as investors underwrite significant upside potential.

For more information, visit JLL Research

For more information, visit JLL Research