Incredible fundamentals surrounding the New Jersey industrial real estate market has resulted in record investor demand, resulting in Class A cap rates steadily dropping since the end of the great recession to cycle lows, with some buildings trading with cap rates below 4.0 percent.

Office leasing velocity gains traction

More than 2.3 million square feet leased during Q3 compared to a lagging 1.4 million square feet in Q1 2018. A 33.0 percent increase in active tenant requirements from one year ago represents nearly 6.0 million square feet. Accelerated leasing velocity is expected to continue in Northern and Central New Jersey through year-end 2018 and into 2019.

Big-box demand struggles with limited supply

The proliferation of e-commerce spiked leasing velocity in 2016 and 2017 due to significant demand for big-box and mega-box spaces.

Limited supply of big-box space across the state has stalled leasing velocity for YTD 2018.

There are only five (5) availabilities in excess of 500,000 square feet in the state.

Tenants have expanded the geographic scope of requirements into Southern New Jersey and Lehigh Valley to accommodate immediate needs.

Big box space conundrum

At mid-2Q 2018 only three Class A industrial buildings larger than 500,000 square feet were available for lease throughout New Jersey. The shortage of space caused leasing to slow down at the start of the year without any big-box leases signed in first five months of 2018. On a positive note, five buildings greater than 500,000 square feet are set to break ground in 2018.

Vintage office inventory poised for upgrades

In early 2018, throughout the Northern and Central New Jersey office market, nearly 38.0 million square feet of direct and sublet space was marketed for lease. Buildings constructed since 2010 comprised less than 1.0 percent of the available space, as office occupiers gravitated towards newer product. An empty construction pipeline will challenge tenants seeking modern work environments prompting owners of vintage inventory to invest in improvements and upgrades that fulfill tenant requirements.

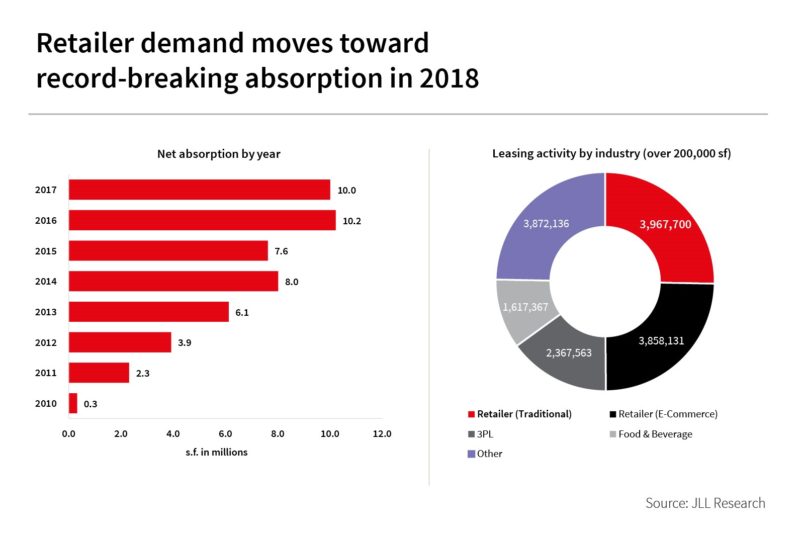

Retailer demand moves toward record-breaking absorption in 2018

Changes in consumption patterns continue to shift retailer demand away from brick-and-mortar storefronts to industrial facilities with immediate access to large swaths of the U.S. population. In 2017, traditional and e-commerce retailer requirements exceeding 200,000 square feet totaled 7.8 million, representing a 120 percent increase over the 2016 total of 3.6 million.