As corporate occupiers transform their work environments to maximize efficiency and attract and retain talent, traditional office space has evolved. This demand is the catalyst for architects and designers to re-evaluate the function of the office, resulting in significant changes in work space.

Sponsored Content

Office leasing velocity gains traction

More than 2.3 million square feet leased during Q3 compared to a lagging 1.4 million square feet in Q1 2018. A 33.0 percent increase in active tenant requirements from one year ago represents nearly 6.0 million square feet. Accelerated leasing velocity is expected to continue in Northern and Central New Jersey through year-end 2018 and into 2019.

Logistics users scramble for quality space

A drought in modern space options is rippling through the New Jersey Industrial market, creating challenges for logistics users while providing opportunities for developers. Class A availability has fallen to cycle lows of 5.5 percent, a far cry from last cycle’s peak when Class A availability reached 27.5 percent.

Langan knows OZs in NJ

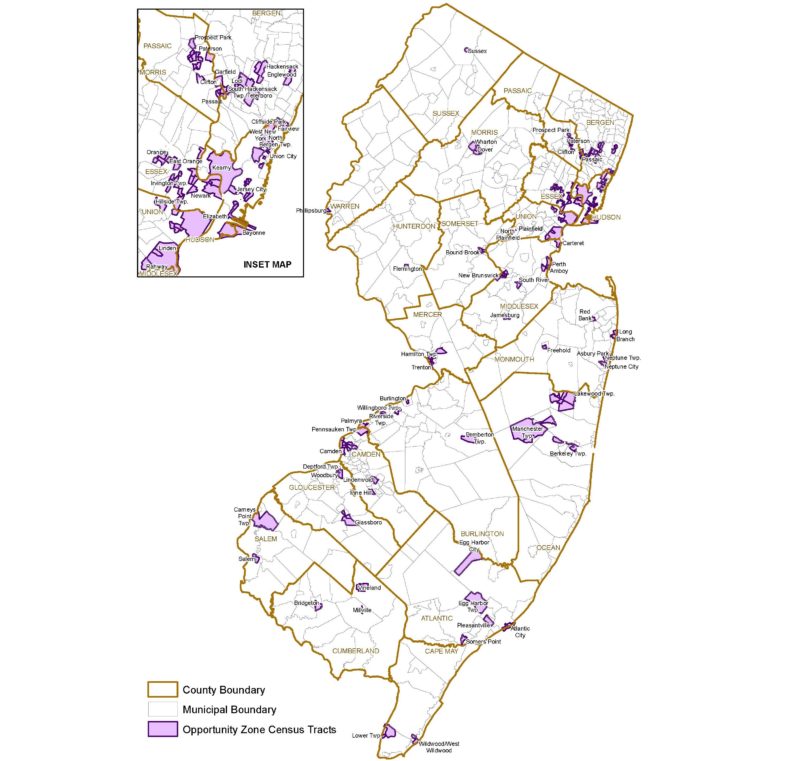

Enacted as part of the 2017 federal Tax Cuts and Jobs Act, the Opportunity Zones program will bring development into low-income areas. While investors and developers take steps to form Qualified Opportunity Funds (QOFs), Langan is well positioned to support substantial improvement projects among the 169 tracts within 73 towns in New Jersey. In fact, because of our near half-century of providing engineering and environmental services in our state, we have the right experience and site knowledge to help maximize investments in our OZs.

Big-box demand struggles with limited supply

The proliferation of e-commerce spiked leasing velocity in 2016 and 2017 due to significant demand for big-box and mega-box spaces.

Limited supply of big-box space across the state has stalled leasing velocity for YTD 2018.

There are only five (5) availabilities in excess of 500,000 square feet in the state.

Tenants have expanded the geographic scope of requirements into Southern New Jersey and Lehigh Valley to accommodate immediate needs.

Transit hub markets speed away from competition

Office buildings within the state’s transit hub market record lower vacancy rates and higher rents compared to suburban spaces, according to JLL’s annual research report. Companies continue to pursue office space in proximity to walkable amenity-rich areas and with access to mass-transit options for their workforces and clients.