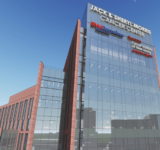

1049 Secaucus Road in Jersey City — Courtesy: CenterPoint Properties

By Joshua Burd

A regional brokerage team with CBRE is hailing more than $1 billion in sales in 2019, highlighted by the $151.2 million trade of a nearly 320,000-square-foot logistics center in Jersey City.

The real estate services firm announced Tuesday that its CBRE National Partners Northeast group completed investment sales valued at $1.09 billion in New Jersey, reaching record values per square feet. The team — which includes Brian Fiumara, Michael Hines, Brad Ruppel and Lauren Dawicki — last year arranged 17 sale transactions totaling 8.3 million square feet, far surpassing its activity from the prior few years.

“2019 was a record-breaking year for our team in the state of New Jersey,” said Fiurama, a vice chairman with CBRE. “We are extremely proud of the work we have been able to achieve for our clients and look forward to an even more successful year in 2020.”

Among the completed transactions were the $151.2 million sale of FXG Jersey City, a 315,389-square-foot FedEx Ground facility at 1049 Secaucus Road in Jersey City to CenterPoint Properties, and the $93.27 million sale of nine New Jersey assets on behalf of Rubenstein Properties. The group also completed deals such as:

- The $77.94 million sale of a 650,000-square-foot building at 240 Mantua Grove Road in West Deptford

- The $56.1 million sale of Milford Road East in Windsor

- The $37.8 million sale of a 215,440-square-foot property in Mount Olive

“Our capital markets team has built a strong reputation for the creation of value in each and every transaction,” said Jeff Hipschman, senior managing director of CBRE’s New Jersey offices. “Our ability to fully leverage the institutional demand for New Jersey industrial product utilizing our global platform has generated record value and pricing per square-foot for our clients.”