By Joshua Burd

The swell of cargo volume at the Port of New York and New Jersey has fueled the Garden State’s lowest industrial vacancy in more than 15 years, according to Transwestern, as rents continue to rise and leasing activity continues at a torrid pace.

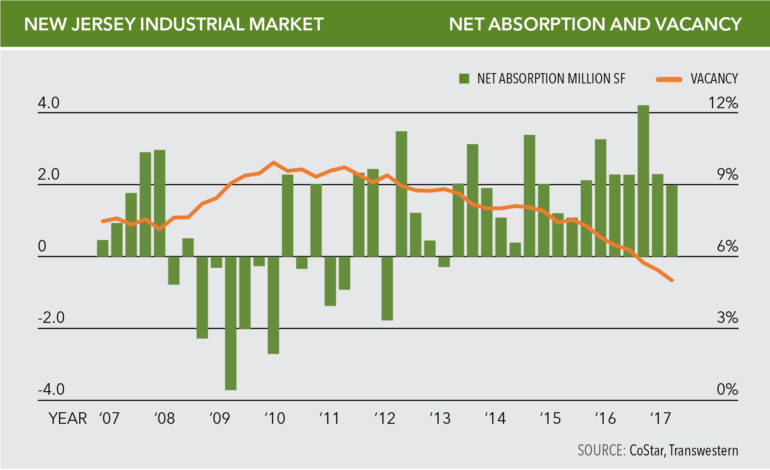

New research by the firm’s Parsippany office noted that cargo volume is in the region continued to be robust through February, following record-setting growth in 2015 and a comparable level in 2016. The port activity, along with upticks in manufacturing activity in the state, has pushed vacancy to 5.1 percent, a significant drop from 6.5 percent a year ago.

The industrial market in northern and central New Jersey has recorded 16 consecutive quarters of positive net absorption, including 15 with more than 1 million square feet absorbed, Transwestern found. The firm pointed to leases such as Target’s 718,000-square-foot commitment at BridgePort Logistics Center in Perth Amboy and a 365,400-square-foot deal by Automann USA at 400 Docks Corner Road in South Brunswick.

The first quarter of 2017 marked the third consecutive quarter during which more than 10 million square feet was absorbed over the prior 12 months.

Transwestern said that, as a result, industrial rents continue to exceed all-time highs — reaching a new peak of $6.98 per square foot during Q1. That marks a year-over-year increase of 14 percent.

“As New Jersey continues to set new records for port volume, demand for modern warehouse space is as strong as ever, and manufacturing is picking up steam,” Lori Zuck, managing director with Transwestern, said in a prepared statement. “In turn, we’re gradually seeing new product being delivered throughout the state, and while the Turnpike remains the primary corridor, development has spread to the outer rings of the region’s industrial market.”

The Target and Automann leases were the largest of the first quarter, which saw 10 deals greater than 150,000 square feet, including four new leases in newly constructed properties. Another large commitment came from a manufacturer, Virginia Dare, which makes and supplies flavors for the food and beverage industry and has leased space at a new, 206,500-square-foot property at 900 Federal Blvd. in Carteret.

Transwestern also reported that the market experienced the strongest quarterly improvement in vacancy since fourth quarter 2015, while the average asking rent for manufacturing buildings averaged $6.52 per square foot. That’s up from $4.98 per square foot five years ago.

With the market firing on all cylinders, experts with the real estate services firm expect there to be continued healthy demand for the more than 10 million square feet of industrial space currently under construction in the northern and central parts of the state.

“New Jersey’s industrial market is off to a quick start in 2017, as we saw increases in rents in 21 of the 25 submarkets that we track,” said Matthew Dolly, Transwestern’s New Jersey research director. “And we expect the high level of activity to continue through the remainder of the year, as consumer confidence is currently at its highest level since December 2000 — a good sign for the retail and wholesale sectors, which are growing rapidly in New Jersey.”